Why can’t Venmo show the exact value of the cash advance fees I might be charged?

The only way to be certain whether or not your card issuer will charge a fee is to ask them directly. If we think your credit card could charge an extra fee, we try to warn you before you make a payment on Venmo. Which credit cards charge cash advance fees? Things could add up! Be sure to check with your card issuer about the fees they may charge. They might also charge other cash advance service fees including a higher APR. When you send money to a friend on Venmo, your card issuer may charge an additional fee (either a fixed dollar amount or a percentage rate–whichever value is higher). The interest rate for this type of transaction is usually higher than using the credit card for a purchase. The complaint notes that the Truth in Lending Act (TILA) requires that account opening disclosures for credit cards be “clear and conspicuous.” The complaint claims, “Compliance with these disclosure requirements is accompanied by clearly stating the applicable interest rate, charges, and fees to certain types of transactions, especially if different types of transactions incur different rates.”Īccording to the complaint, Citi has breached its own card agreements and violated TILA.Cash advance fees are the same fees that are charged when you use a credit card to withdraw money from an ATM or branch.

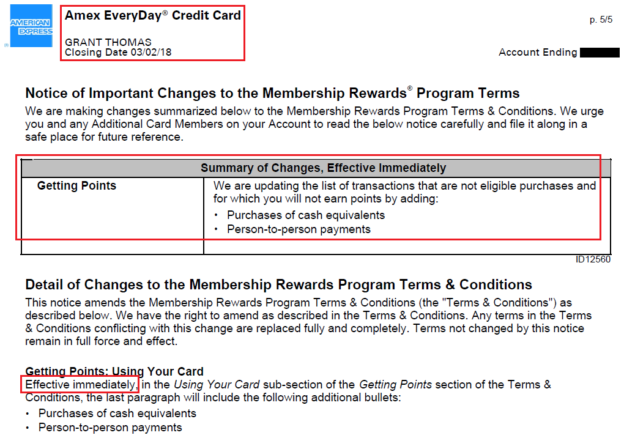

Yet Citi elected not to amend its current Card Agreement terms or otherwise advise its cardholders of the impending change…” The complaint alleges that this reclassification decision, undisclosed to customers, “amounted to a significant material deviation from its application of its Card Agreement account terms. However, according to the complaint, in 2020, “without warning or advance notice to its consumers, Citi began to re-classify purchase transactions made through MEP Apps funded with Citi consumer credit cards as cash advances.” This is a worse deal for cardholders, the complaint says, because cash advances do not have an interest-free grace period, may incur a separate fee for each such transaction, and may be held at higher interest rates. This is advantageous to the cardholder, since it comes with standard interest rates and interest-free grace periods and does not involve a transaction fee. Whether Citibank charges a transaction fee (such as a cash-advance fee)Ĭitibank originally classified MEP app transactions as standard purchases, the complaint says.Whether it comes with an interest-free grace period, where it can be paid off without an interest charge.The interest rate applied to the transaction.The categorization of the transaction will determine the cost of credit to the cardholder, in at least three respects: Traditionally, Citi has classified as cash advances things like getting cash from an ATM through the use of a credit card and making cash-like purchases such as obtaining casino chips, buying money orders, making wire transfers, and purchasing traveler’s checks. When consumers make transactions with a Citibank credit card, Citibank puts them into one of three categories: standard purchases, balance transfers, or cash advances. When a user pays with, for example, PayPal, the cost of the transaction is taken first from any money on file in PayPal and after that from a designated bank account or payment card.Ĭitibank is one of the largest US issuers of credit cards.

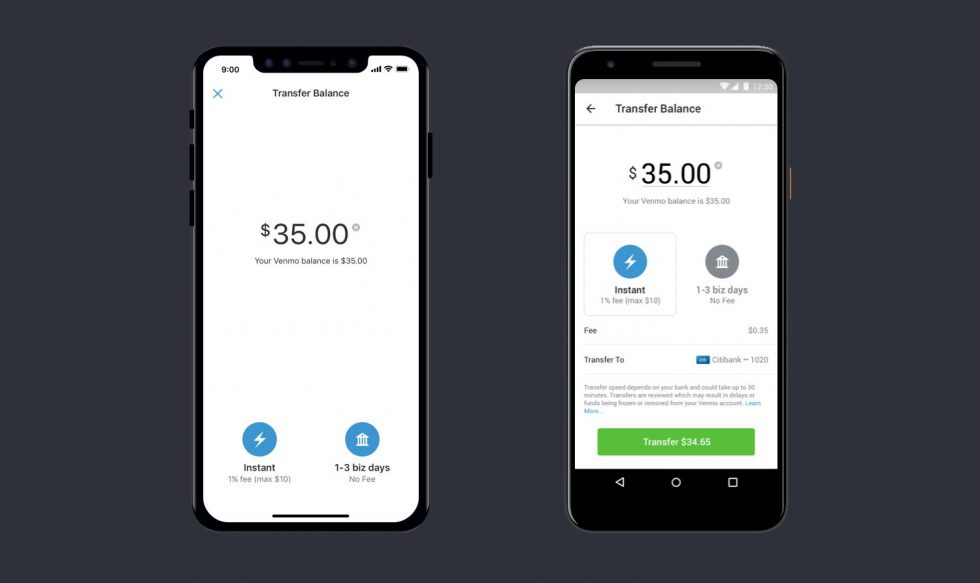

The National Class for this action is all persons and entities who, within the applicable statutes of limitations, used a mobile electronic payment application to fund a transaction with a credit card issued by Citibank, and where Citibank classified the transaction as a cash advance. The problem addressed in this class action has arisen from the use of mobile electronic payment (MEP) apps, like Venmo, PayPal, and Cash App to pay for purchases: How should these be classified by the linked banks and credit cards, and why does this matter? The complaint brings suit against Citibank, NA, alleging that the misclassification of purchases made with its credit cards costs users extra money.

0 kommentar(er)

0 kommentar(er)