- Car loan payment calculator with credit score for free#

- Car loan payment calculator with credit score how to#

Car loan payment calculator with credit score for free#

To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. The Forbes Advisor editorial team is independent and objective. If you’re considering a loan that’s secured by your home, be sure you understand the differences between HELOCs and home equity loans. Home equity lines of credit (HELOCs) and home equity loans are financing options that the equity in your home secures. This makes a line of credit an excellent option for projects or events where expenses will be spread over several months or years.

Unlike a personal loan, which you receive as a lump-sum amount, a line of credit lets you access funds up to a certain limit on an as-needed basis you will only pay interest on the amount you borrow. However, if you have a strong credit score, you may be able to qualify for an interest-free financing credit card, which can save you money on interest payments. Credit cards typically have higher interest rates than personal loans but may be easier to qualify for if you have damaged credit. So this option should be avoided when possible. Keep in mind, taking money from a qualified retirement account before the designated retirement age often includes an early withdrawal penalty. You can avoid fees and interest if you’re able to cover your expenses with savings. If it doesn’t feel like the right financial decision for you or you don’t qualify, consider personal loan alternatives including: Personal loans aren’t right for everyone. To receive the most favorable interest rate, be sure to maintain a good-to-excellent credit score of at least 720, have consistent income and reduce any unpaid debts. However, the rate you’ll receive heavily depends on your credit score, income and overall creditworthiness as a potential borrower. Related: 5 Personal Loan Requirements To Know Before Applying What Is a Good Interest Rate on a Personal Loan?Ī good interest rate on a personal loan is one that’s lower than the national average, which is about 12%. If you decide you want to pay off your loan early, be sure to check if your lender charges a prepayment penalty. Setting an autopay is a handy way to never miss a payment. Repay your loan. Once you receive the funds, your repayment period will begin.Depending on the lender, this process can take a few hours to a few days. Once you find a lender that offers you the best terms, apply online or in person. Submit a formal application and await a lending decision.Many lenders will let you prequalify before applying, which lets you see the terms you would receive without a hard credit inquiry or damaging your credit score. Shop around for the best terms and interest rates.Keep in mind, you’ll receive your funds as a lump sum and have to pay interest on the entire amount-so only borrow what you need. Calculate how much money you want to borrow. Determine how much you need to borrow.If your score falls below 610 or you want to boost it to receive the most favorable terms, take time to improve your score, such as lowering your credit usage or paying off unpaid debts.

Car loan payment calculator with credit score how to#

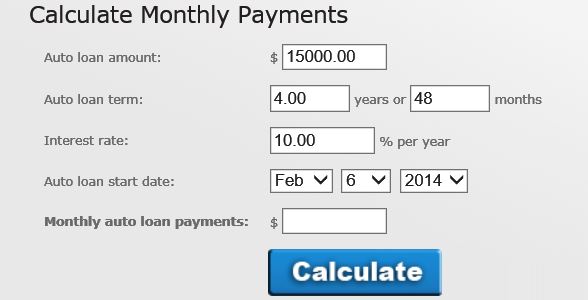

Related: Compare Personal Loan Rates How to Get a Personal Loan Use the personal loan calculator above to see how much you’d pay, per month and overall, which will help you compare your options. Along with making sure you can afford the monthly payment, it’s important to know whether a personal loan is right for you. Personal loan rates are often lower than credit card cash advance APRs but higher than what you’d pay if you qualified for a 0% APR credit card. When you take out a personal loan, you’ll receive a lump sum that you’ll pay back in fixed monthly payments, over the course of a loan term that you choose. A personal loan is an installment loan that can help borrowers meet a wide range of goals, including consolidating debt and covering big purchases.

0 kommentar(er)

0 kommentar(er)